Payment Processing: 10 Key Features for Small to Medium-Sized Businesses

Payment processing can be dull and monotonous without the right support. Luckily there are helpful payment processing tools to help your business spend less time collecting payments, and more time taking care of customers.

What is a payment processor?

A payment processor is a third-party company used by businesses to accept credit and debit card payments from customers.They are built to handle all or most payment situations, such as when your client is standing at your office using your POS (Point of Sale) terminal, paying online via a web browser, or using their mobile app to submit the payment. Payment processor capabilities will vary depending on which company you use.

With so many payment processing options on the market, you may find it challenging to know which one is the best solution for your smaller-sized business. To make your decision easier, we’ve prepared a list of 10 important things to consider.

How Payment Processing Works

Payment processing is a multi-step operation that enables businesses to securely accept and manage customer payments, whether online or in-person. At Weave, we ensure this process is efficient and seamless so you can focus on providing exceptional service. When a customer makes a purchase, their payment information—via credit card, debit card, or mobile wallet—is captured by the point-of-sale (POS) system or online checkout page. This data is then securely transmitted through a payment gateway, which encrypts and forwards the details to the acquiring bank (the merchant’s bank) for protection against fraud.

The gateway sends the transaction request to the customer’s issuing bank, which verifies if there are sufficient funds or available credit while checking for potential fraud. Once validated, the issuing bank sends an authorization response—either approval or decline—back through the gateway and to the POS or online platform, all within seconds to ensure a smooth customer experience. If approved, the transaction is settled, meaning funds are transferred from the customer’s account to the merchant’s account, typically within a few business days. At Weave, our payment processing system is built to manage these steps effortlessly, providing secure, quick, and flexible payment options that fit the needs of your business.

What features should you look for in a payment processor?

1. Transparent and Honest

Find a payment processor that is clear about what to expect as a user, including the capacity, product features, fees, and contractual terms. Businesses that fully understand the commitment and value being delivered to them by their payment processor are likely to make a decision they won’t regret.

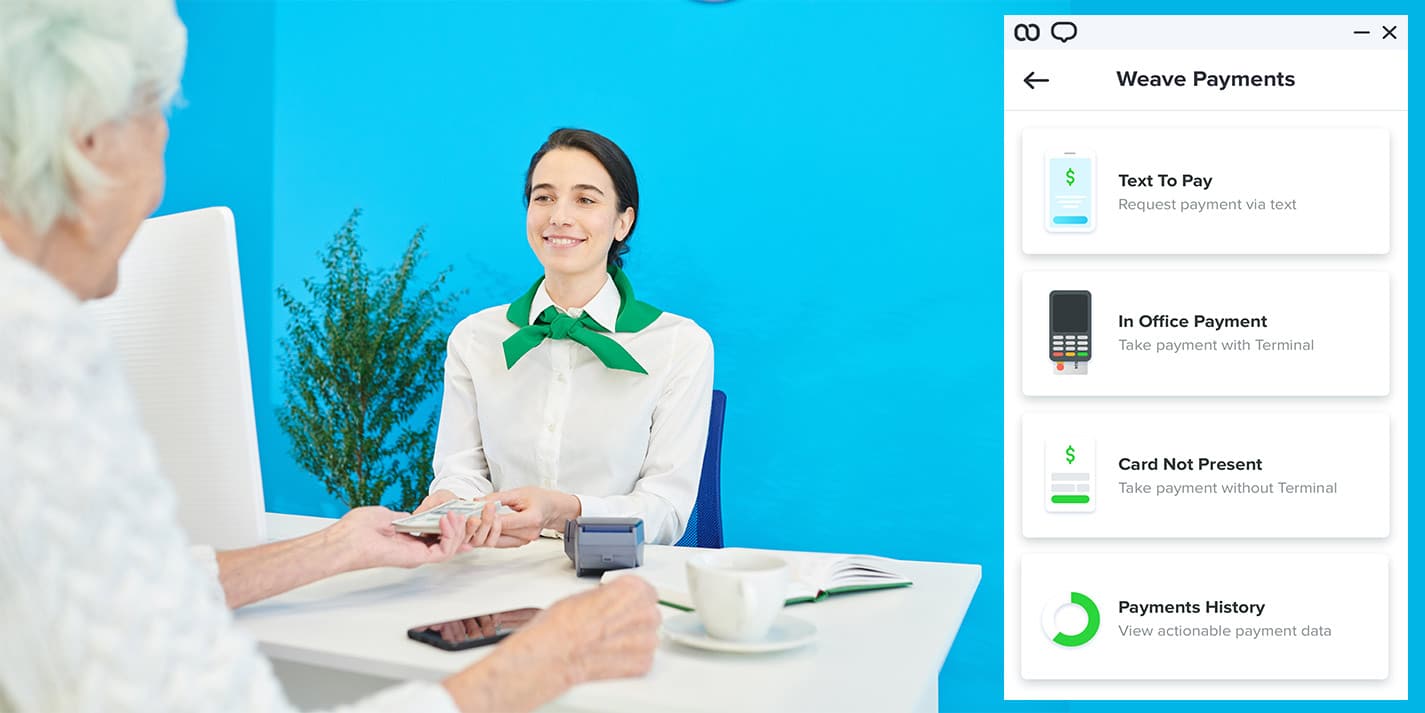

For example, Weave Payments operates in a way that is crystal clear and undemanding with no upfront or ongoing hidden fees. Additionally, there are no long-term contracts to keep you in a bind, should you need to end service. Instead, one flat rate is offered for card-present and card-not-present transactions occurring in person, over the phone, or online. To help businesses with their check-out procedures and credit card processing, Weave Payments provides two free terminals to each client. The top-notch POS Verifone p400 terminals have advanced features like color and touch-screen capability. They also connect using WiFi or Ethernet, thereby eliminating the need for phone lines. Furthermore, as long as a customer wants to use Weave’s POS terminals, an effort is usually made to meet or beat their current pricing.

No matter which payment solution you decide to go with, make certain you have all the information you need before you get on board. You can learn more about Weave’s payment options and request a quote here.

2. Time-Saving

An integrated full payment processor is the solution to cutting down time spent on your billing and payment processes. Imagine, the following scenarios.

Scenario:

Your customer is in a hurry and can’t stay back to pay in your office. To give your customer the flexibility to pay later, you can choose a payment processor that allows them to get to their next appointment and pay you while on the go via text.

We can’t help but weigh in on the value of Weave payments, again. Weave Payments is part of a consolidated office toolbox that allows office staff to quickly send text messages to clients to pay on their devices at their convenience. Weave’s clients love this feature because it allows them to receive payments so effortlessly. One of them, an Optometry office in New York collected over $1,000 from accounts receivable with “text to pay” in just about 24 hrs!

more about

Weave?1 System for Phones, Texting, Payments, & More

Access a full suite of patient communication tools with Weave! Texting, payments, reviews, & scheduling in one place. Get started today!

Get Started

3. Convenience

With the rise in the popularity of mobile devices and smartphone users across all age groups, payment processing tools have been designed to accommodate all methods of digital payment. Research shows that:

- About 93% of customers would like to text the businesses they support (especially when it has to do with mundane bill collection).¹ The same study also reports that 92% of US adults carry text-enabled phones. With these figures showing a huge preference for texting, it would be wise for any small business to use texting as an effective way to reach customers.

- 98% of smartphone users use text quite frequently. Knowing this fact can reassure a business that its customers are more likely to reply if they are sent a text, than if they try to call the customer and end up playing phone tag.²

The statistical evidence shows how inseparable the smartphone and the human being have become, so accepting payments online and on mobile devices is a smart move for any smaller to medium-sized business.³

Mobile and text payments are not the only things that make it more convenient for your customers to pay you. Accepting credit cards is also a huge convenience for your customers. Nearly 40% of small business customers say they usually don’t carry enough cash to make cash purchases at the stores they frequent most. Another convenience is offering financing plans, or Buy Now, Pay-over-time options that let customers split the cost of everyday needs and services into manageable payments over time.

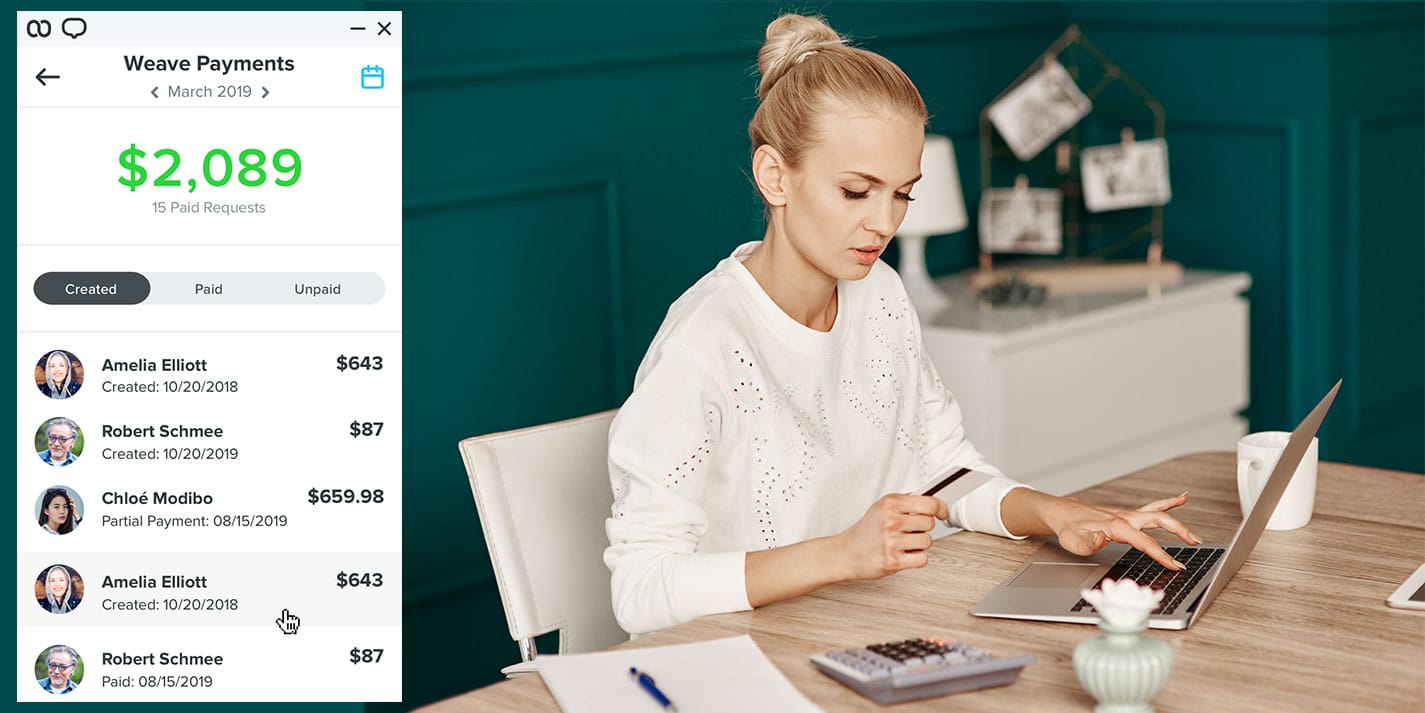

4. Simple Reporting

Did you know that a payment processor can provide useful financial insights in an uncomplicated manner? Having instant, easily accessible, and up-to-date financial insights on any business is vital to making better decisions.

Weave Payments makes this possible with the convenient integration of Weave Customer Insights and Weave Phones that allows businesses to automatically know when a client has an outstanding balance and easily request payment using a brief personalized text message.

5. Accepts Multiple Debit and Credit Card Payments

You might be tempted to assume that all credit and debit card payments would be accepted by your payment processor, but it’s important to confirm this. You’ll need to ensure that your merchant account provider allows your customers to use practically any payment method of their choice. Whether your customer wants to pay with American Express, Visa, Discover, or Mastercard, your business should be able to comply. In the New York client’s claim above we discovered that accepting payments in the customer’s preferred manner encouraged quick payments, even same-day payments. Such flexibility also encourages customers to do future business with your company.

Accepting the payments that customers would like to pay with seems like a no-brainer when research shows that the more options you make available to your customers, the happier you both will be.

With Weave Payments there’s no need to worry about the types of payments that are accepted as it processes all card types (debit, credit, HSA/FSA), uses various payment technologies (Magstripe, EMV chip, NFC), and accepts most mobile wallets (including Apple Pay, Google Pay, Samsung Pay).

6. Paperless Process

Reducing the amount of paper used by your office to process payments has advantages such as:

- Less hard cash to count at the end of a long workday.

- Less likely to find counting errors when balancing your accounts.

- Saving money and time as you buy less stationery (paper).

- Gas and time are also saved when there’s no need to drive and wait in line at your merchant bank to place money into your business account.

- More spending power for your business when you collect money digitally from outstanding client accounts.

If you’ve imagined a payment processor that makes it unnecessary to send paper bills in the mail or make collection calls, you might want to look into Weave Payments. You will get paid by your customers from their mobile phones from anywhere in the world, quickly and easily, even while they are vacationing in Fiji if they choose to. Weave Text to Pay enables easy customer payment with a mobile device just using a text link.

7. Reliable Service

Every merchant wants a thriving business and to meet their business growth goals. As some days may get busier than others, you need to ensure that your payment processor can handle high volume usage by customers as your company increases in size and reach.

A highly functioning payment processor can lead to better customer experiences, which fosters greater customer loyalty and retention, larger profits, and reduced costs. On the other hand, a terrible payment processor can have adverse effects on your business, such as customer complaints and missed business opportunities.

8. Simple User Interface

You’ve likely experienced leaving a product behind or avoiding a business because the check-out or sales process was ridiculously long, complicated, or impossible. Having said that, do some research on how your payment processing provider will work for your customers’ needs. Choose one that is user-friendly and simple for your customers or patients.

9. Ease of Implementation

If you’re hoping to expand beyond your local brick-and-mortar store, you’ll need to figure out how your payment processor will function with foreign currencies in international markets. You shouldn’t have to invest in another tool just because your business is growing and neither should you stump your growth.

Find a processor like Weave’s smart technology to help you do more for your entire customer base with less.

10. Security

The saying, “money doesn’t grow on trees,” rings true for your business and your customers. People will not spend money with a company they don’t trust. Since not all payment gateways are secure, be sure to purchase a payment processor that protects your data and clients’ info from risk and exposure to hackers.

For instance, when consumers fill out payment forms with their card details, your payment platform must be capable of keeping their data safe from fraud. In the case of Weave Payments, a highly secure online PCI-compliant payment gateway is managed through Stripe Express.

From the first phone call to the final payment, Weave’s unique integration of hardware and software solutions helps businesses grow, retain and communicate across the entire customer journey.

Conclusion

Search for a payment processor that will transform your customer service, reduce the time you spend processing transactions, and give you more hours in the day to focus on tasks that cannot be done by a machine, like personal interactions with your customers. Schedule your free demo with Weave today to learn how you can process payments more efficiently.

Resources:

- Implement Business Text Messaging To Draw More Local Customers

- 44 Mind-Blowing SMS Marketing and Texting Statistics

- 10 facts about smartphones as the iPhone turns 10