New Study on Payment Transactions: Customers + Small Businesses Share Advice

Small business owners and customers share one common objective– to exchange something of value for something else of similar value. But despite this common objective, conflict of interest can arise over payment options, thereby putting the performance of your business at risk.

Since the success of your business depends heavily on customer satisfaction, the challenge for the business owner is to provide payment options that are convenient for your customers (and your business).

As a leader in digital payments tools, Weave commissioned an independent market research firm to survey a random sample of 380 small business customers and 350 small business owners to learn how to make transactions easier for both parties.

More specifically, Weave wanted to discover:

- How do customers prefer to pay for their purchases.

- The impact of payment options (or the lack thereof) on sales and customer retention.

The key findings from the survey are outlined below.

How many customers carry cash and how much are they carrying?

- Only 36% of small business customers stated that they always carry cash.This explains why business owners are saying that only 36% of customers who walk into their store are carrying enough cash to make a purchase.

- Those small business customers who actually carry cash, carry $80 in cash on average. This is contrary to what business owners are thinking. They say on average their customers carry $119 in cash. Business owners are overestimating the buying power of customers who make cash purchases.

- 43% of small business customers say they carry less cash today than they did 1 year ago.

- Only 20% of small business customers are sure they carry enough cash to make a purchase in the stores they frequent.

- Nearly 40% of small business customers say they usually don’t carry enough cash to make cash purchases at the stores they frequent most.

If this is the case and your business is only open to cash payments, then some quick math would show that the majority (64%) of customers who come to your business without cash, will not be able to make a purchase, if other forms of payments are not accepted. Moreover, those customers that are actually carrying cash, are likely to have limited spending power.

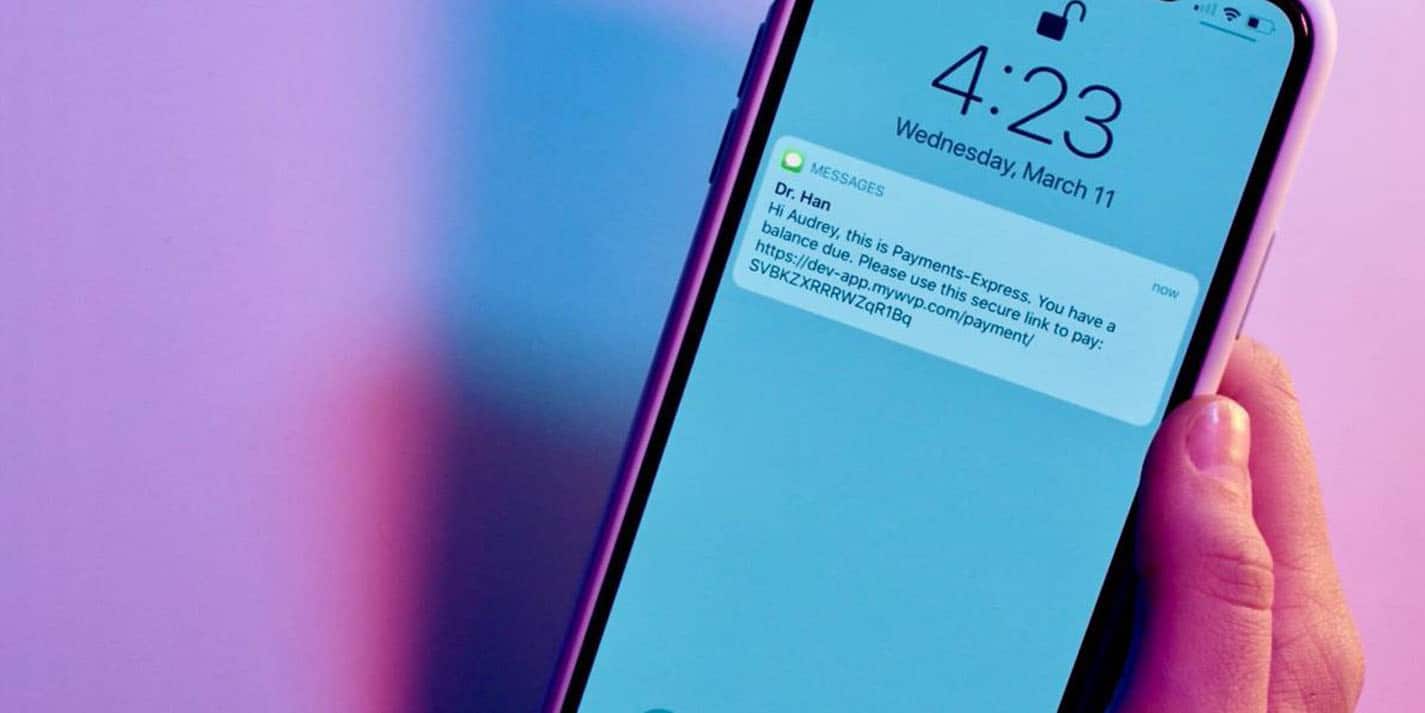

Should you decide to open your payment options to include the acceptance of cards, be aware that charging card usage fees to customers, can deter them from doing business with you. "Weave Payments has replaced the majority of our monthly billing statements. And since we can bill {clients} directly through text, we save a huge amount of time billing them as soon as their balance is available, rather than spending three days a month billing in bulk.; - Cambria, Office Manager

Instant Billing & Quicker Collections Are Possible

How do customers feel about being charged for using their credit cards to make purchases?

- 19% of small businesses charge customers a fee if they use a credit card, but 71% of small business customers say they try to avoid businesses that charge fees to use a card.

- 41% of small businesses that charge a credit card fee worry it will cost them their customers. They have reason to worry because of the 71% of small business customers who are avoiding businesses that charge fees to use a card.

- 27% of small business owners say they pass on credit card fees to the customer, despite the 71% of customers who refuse to shop at businesses who do so.

Here is some alarming data on credit card fees:

- Over 1 in 4 small businesses pass on their credit card processing fees to customers, but 3 in 4 customers suspect businesses pass on those fees.

- Nearly half of small businesses don’t know what their credit card processing fee is.

This data speaks for itself.

Which MOST unaccepted payment types do customers wish were accepted often?

- 38% of small business customers have been unable to make a purchase at a physical store because their form of payment wasn’t accepted.

- These are the most common unaccepted payment types at physical stores according to customers:

- Credit card

- Check

- Mobile payment

Can you imagine the frustration of a customer driving all the way to your business to purchase an item or to receive a service, only to find out at check out that their payment will not be accepted?— Not because there’s anything wrong with it, but just because your business does not want to take it.

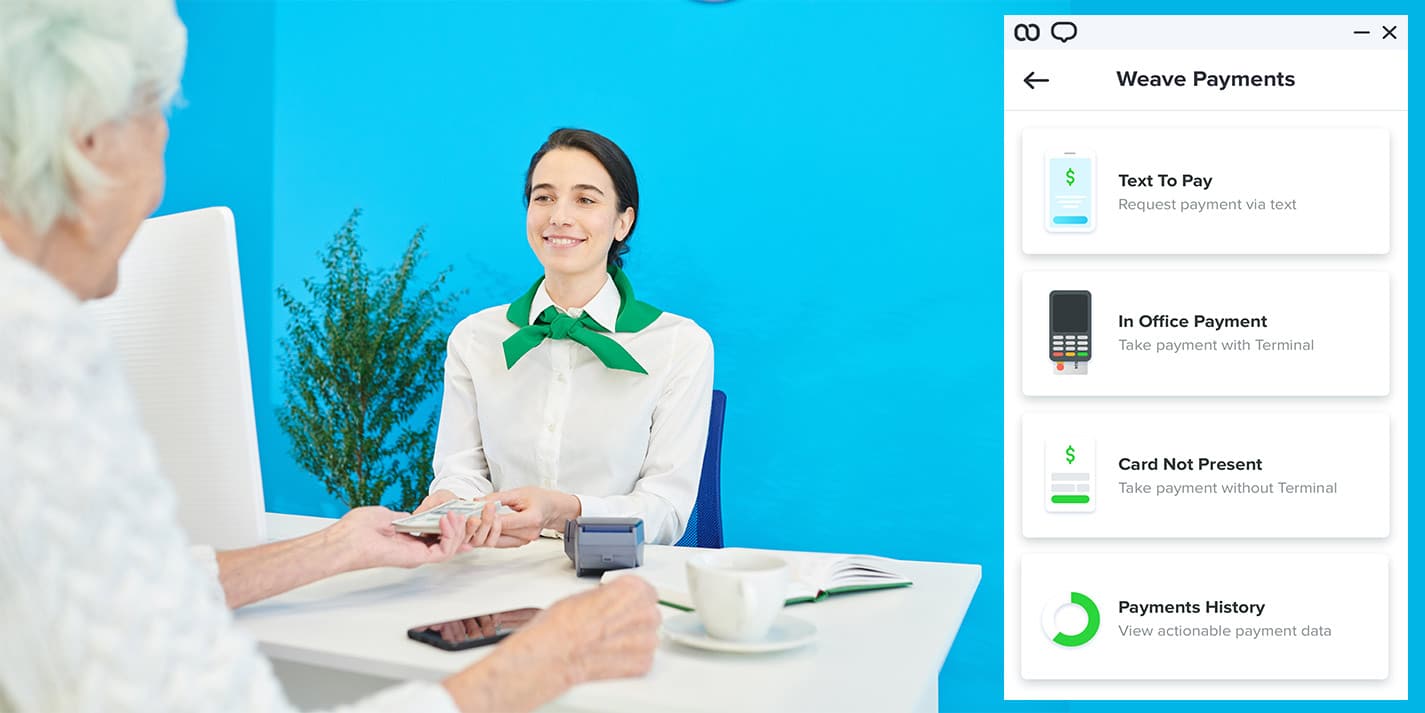

Did you know?— Customers WANT to make Mobile Text Payments.

- 35% of customers are interested in paying with a text from their phone but only 4% of small business offer it.

- Small business customers under 35 are over 2x more interested than older buyers in paying with a phone text.

- 4% of customers have been unable to complete their purchase at a physical store because they wanted to pay via text.

- Small business customers under 35 are 2x more likely than older buyers to have not completed a purchase at a physical store because a store didn’t accept text payments.

- 6% of customers have been unable to complete their purchase at an online store because they wanted to pay via text.

- 30% of small business customers would frequently or always pay with a text from their phone if they could. That number more than doubles to 62% for buyers under 35.

- 17% say that text is their preferred payment method, but it is frequently rejected by small businesses as a form of payment.

These numbers show that small businesses are losing customers and potential sale opportunities by not accepting mobile payments. Mobile Payments offer convenience to those who don’t like to carry to around physical wallets and want to be able to pay from anywhere.

- This study also shows 31% of small businesses are looking for alternatives to credit card payments. We think text to pay might be a wise solution.

Places where customers most want to be able to pay with a text:

- Grocery store

- Restaurant

- Gas station

- Doctors office

- Movie theater

Businesses are literally chasing many customers away and experiencing financial losses due to limited payment options.

If you’re a small business that refuses certain types of payments from customers, you may have wondered why you’re losing customers or why your business is not growing. The answers to these questions lie within these statistics:

- 41% of customers avoid certain stores because they don’t accept the right payment type.

- Small business customers under 35 are nearly 2x more likely to avoid small businesses that don’t accept the right payment type.

- 30% of small business customers have been unable to make a purchase at an online store because their form of payment wasn’t accepted.

- 16% of small businesses have lost a customer in the past month because they didn’t accept the type of payment the customer wanted.

- To go along with that, 38% of customers say they’ve been unable to purchase from a small business because their payment wasn’t accepted.

Loss of sale due to lack of payment options is exceedingly evident.

- More small businesses have lost a sale because they didn’t provide enough payment options than they have lost a sale because of bad reviews.

By making more payment options available, you will attract and retain customers and experience revenue growth, but right now, only 16% of small businesses offer more than 3 forms of payment.

Managing a business can be challenging and uncertain. It is good to know that the majority of small business owners are confident in their endeavors.

- 93% of small businesses are optimistic about the future of their business.

- Businesses that accept more than 7 types of payments are more likely than those that don’t to be optimistic about their business.

Small business owners estimate the financial impact of refusing certain types of payments on their business:

- Revenue would drop 6% if they didn’t accept mobile payments.

- Revenue would drop 2% if they didn’t accept text payments.

- Revenue would drop 14% if they didn’t accept payment services like Venmo or PayPal.

- Revenue would drop 26% if they didn’t accept checks.

- Revenue would drop 21% if they didn’t accept credit cards.

- Revenue would drop 18% if they didn’t accept cash.

Many small businesses admit that if they were to offer more payment options they would be doing better.

- Nearly half of small businesses say that the more payment types they accept, the more money they make.

- 40% of small businesses say that accepting more payment types will help them win over young customers.

- There is a tendency for businesses that accept 7 or more forms of payment to have more employees.

Not accepting the right payment options costs small businesses more customers than the following:

- Inconvenient store hours

- Poor customer service

- Bad reviews

- Customers having to wait in line

- Unfriendly employees

- Poor product quality

This survey proves that small businesses that offer multiple payment options are bringing in more revenue.

- Small businesses that accept 4 or more payment options bring in 7x more annual revenue than those that accept fewer than 4 payment options.

- Small businesses that accept 4 or more forms of payment have grown their business on average 22% while those that accept fewer than 4 have grown by 17%.

- Small businesses that accept 4 or more payment options grew their revenue by 29%.

Possible reasons why small businesses are concerned about accepting credit cards:

- 37% of small businesses say they overpay for credit card transaction fees.

- 21% of small businesses have had to cut back on spending elsewhere because of credit card processing fees.

How small businesses would invest money if they didn’t spend it on credit card processing fees:

- More marketing

- New products

- Upgrade technology

- Increase employee wages

- Improve digital experience

While accepting credit cards may result in card processing fees, we’ve learned that the monetary returns and gains from accepting credit card payments far outweigh this additional expense to your business. In the end, providing MULTIPLE payment options to your customers is worth it! Watch a demo to learn how to collect client payments faster.