Ep.29: Establishing the Books with Weave’s Financial Expert I Launch A Business

You’re so close to having your business up and running! You’ve laid all of the groundwork, and now you get to purchase your business license and start tracking your finances. This is real, people!

Separate Your Business & Your Personal

Your future self will thank you later. Having separate accounts makes it easier for you to identify the health of your business and maintain healthy financial boundaries with your personal investment. It’s a simple thing. Take the time to go to your bank or credit union and do this now.

This is about giving you a clean structure to follow so that you can be prepared for whatever may come your way, from the beginning.

Setting Up Your System

You don’t have to be a finance guru to have a good system in place. You don’t even have to be an excel wizard. This can be done in either Google Sheets or Excel with some simple formulas.

You’re welcome to access the template for Google Sheets¹, but building it and setting up the formulas yourself may help you better understand what’s going on.

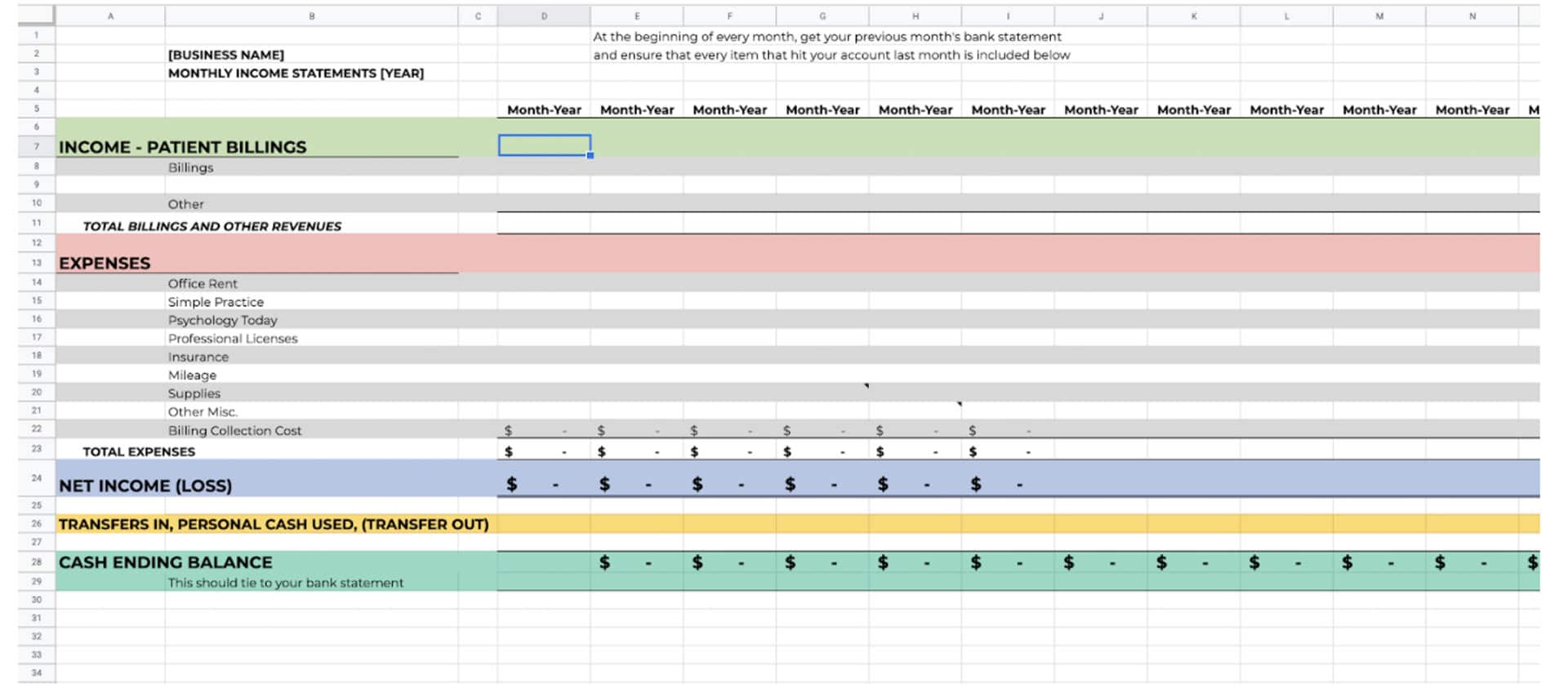

Step One: Replicate the above image. Input all text. Make sure to account for 12 months (though not all 12 are shown in the image).

Step Two: Identify your expenses.

Step Three: Fill in your formulas.

D23: =SUM(D14:D22)

E-O23: repeat the above equation for each column (i.e. SUM (E14:E22)).

NOTE: Columns and numbers do not have to be the same as the example. They do need to directly reflect how and where you’re putting information in the sheet.

Starting in month 2 (in our case, E28), create a formula that will add together 1) the previous month’s ending balance 2) the current month’s income 3) the current month’s transfer’s. In our example it would look like this:

=D28+E24+E26

Repeat this across that row.

Step Four: Add any expenses you’ve already incurred.

Step Five: Set aside time on your calendar every month at the end of the month to balance your checkbook.

Balance Your Checkbook

Every month, check your bank statement to make sure those transactions appear in your sheet as well.

- This will help you simplify what’s in your monthly bank statement. You’ll be able to attribute expenses and income to specific transactions that aren’t detailed on a bank statement. This will be particularly helpful if you have anything outstanding or pending.

- This will serve as a detailed record for taxes or future investors or loans.

Save your future self a headache. At the end of every month, set aside 10-30 minutes to track and confirm everything.