Millennials are the first generation to live in a digitized world during their formative years. Further, Generation Z has been digital since day one.

Depending on your source, the lines that blur generations X, Y (millennials), and Z aren’t exact, but most agree that millennials are born between 1981 and 1996, and members of the Z generation were born between 1997 and 2012.1

Millennials have led the way in demanding convenience and a frictionless payment experience, and now that Generation Z is coming of age, they’re following suit.

As the world becomes increasingly digital, more customers are embracing the idea of paying for goods and services with their phones. In fact, one survey found that 35% of small business customers are interested in paying with a text from their phone. That number more than doubles to 62% when the survey isolated people under 35.

While it’s safe to say that everyone would prefer doing business with a company that offers a unique experience, stellar customer service, and a strong value proposition, millennials are leading the charge by voting with their dollars.

In this article, we examine the seven reasons that text payments are trending among younger customers under 35.

But First, what are Text Payments?

Also referred to as SMS payments, text payments allow a customer to pay for goods and services with their phone instead of swiping a credit card, writing a check, or paying in cash.

The way it works is you send a customer a personalized invoice. You can include anything you want up to 60 characters, as well as a secure link that allows your customer to pay. Customers can even use their mobile wallets like Apple Pay, Google Pay, and Microsoft Pay to complete the transaction.

Text payments are convenient and instant. They’re a win-win for both business owners and customers because they eliminate much of the collection process. No more chasing down clients on the phone to pay their invoices. Now, you can text them!

Why Text Payments are Trending among Younger Customers

Though older generations are slowly adopting this new payment method, younger generations (most notably people under 35) are the most enthusiastic adopters. We’ve identified seven reasons that this is the case.

1. Cash is No Longer King

With the introduction of new payment methods, there’s been speculation that we’re moving to a cashless society. Credit cards, mobile payments, cryptocurrency, and peer-to-peer payments have all replaced cash.

Despite this movement away from paper currency, there will likely always be cash floating around. However, trends show that the younger someone is, the less likely they are to pay for something with cash.

In one study published in the New York Post, respondents between the ages of 18 and 35 were 41% more likely than any other age group to view cash as an “inconvenient” payment method. The study also found that one-third of millennials “rarely or never” carry money.²

These findings beg the question of what payment methods millennials do prefer. Many use credit cards, but a full 63% of millennials say they use their smartphones to complete transactions.³ Smartphone payments include both text to pay options and mobile payments using a digital wallet like Apple Pay, Google Pay, etc.

Weave Helps Streamline Business Communication

"Amazing technology has simplified our {client} communication immensely! We are fairly new and can't wait to learn even more Weave features... customer service and tech support is SPOT ON and can't be beat! " - Weave Customer

Schedule Demo2. People Want to Pay Remotely

The rise of delivery services has made it almost unnecessary to leave the house. Grocery delivery companies like Instacart and food delivery apps like DoorDash, Postmates, and Grubhub can bring everything you need right to your door.

And guess what? Customers pay for these services directly from the app. Even tips are submitted via the app.

Allowing clients to pay via text also eliminates the need for them to travel to your office to pay you. All you have to do is send them a text message with instructions and a secure link, and they’ll be able to pay you from anywhere in the world.

3. Peer-to-Peer Payments are Now a Thing

Younger people are turning to peer-to-peer payments to send instant payments to each other. For example, let’s say ten millennials are at a restaurant. When the bill comes, rounding up cash and credit cards and then figuring out how to split everything up can be a massive pain.

With peer-to-peer payments like Venmo, one person can pay the bill, and the friends can reimburse that person instantly.

Being able to submit a payment using a smartphone makes payments more convenient for everyone, customers and companies alike. While the older generations are slowly adopting these novelty payment methods, millennials have fully embraced them.

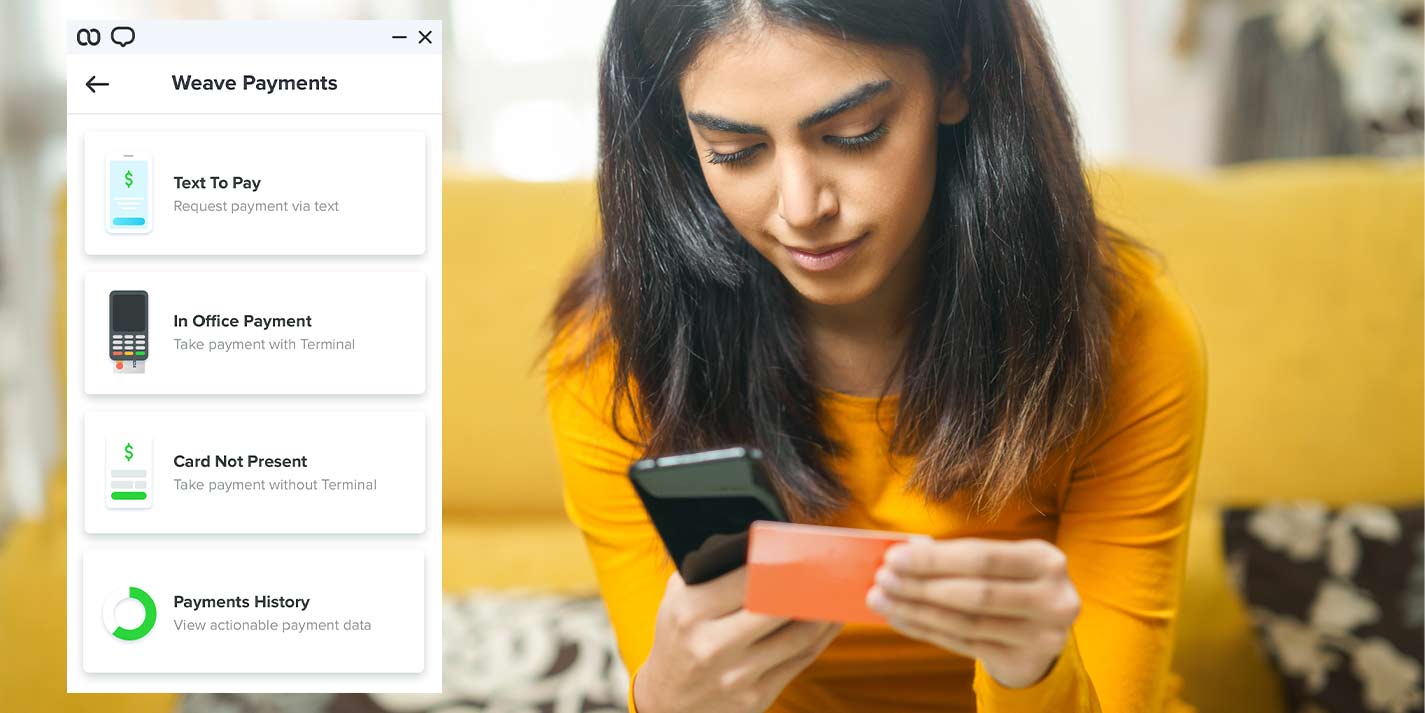

By implementing a high-tech payment system like Weave Payments, you can take advantage of this trend by sending text messages to customers inviting them to pay. Further, Weave’s Text to Pay feature also accepts Apple Pay as well as other mobile wallets.

4. Smartphones are Life

93% of millennials have a smartphone, and that number continues to increase.4 Within the next few years, we could reach total saturation.

And, regardless of age, 89% of people have their smartphones within arm’s reach all of the time.5 Given that smartphones have become so ubiquitous, it makes sense to incorporate them into your payment systems.

Many companies are concerned about late and delinquent payments, and millennials have the highest delinquency rate of any generation.6

So, how do you ensure you get paid? A simple text can go a long way!

Consider these statistics:

- Forbes reports that text messages have a 95% read rate within three minutes.7

- Text message response rates are 209% higher than phone calls.8

To sum up, if you want your payment messages to be seen and responded to, sending a text could be the answer.

5. Contactless Payments Prevent the Spread of Germs

Widespread fears of superbugs and this year’s Coronavirus have made people more paranoid about germs in shared spaces.

Even people that aren’t donning masks during flu season are bound to be concerned about spreading germs with cash and credit cards. Customers are becoming increasingly wary of handing their credit cards to strangers or leaving them on filthy surfaces, unsure of what harmful bacteria and viruses they can pick up along the way.

Text to Pay offers your customers a contactless way to pay. You can send a text message to your clients, and they can pay directly from their smartphone. You don’t have to exchange currency or credit cards. Your customers can also avoid getting grossed out by touching the credit card’s signature screen.

If you run an office focused on health and wellness, contactless payments can be a huge selling point and differentiate you from your competitors.

6. Text Payments Alleviate Security Concerns

Hackers have become incredibly clever and advanced, and they continue to outsmart even people that are savvy and naturally skeptical. Card readers are being compromised in increasing numbers, making it difficult for companies to protect their customers’ financial details.

Text to Pay systems add an additional layer of security because there are no physical payments changing hands. A customer has to use biometric data (either a fingerprint or facial recognition) or a password to access their phone, before they can submit payment and share any financial information. The protocols that protect the payment portal also keep customer information secure.

Though millennials are known as the generation that is least concerned about security, as a business owner, security should be one of your top concerns. This is especially true if your company is subject to HIPAA compliance.

7. People Need Help Staying Organized

Thanks to Marie Kondo’s (and other gurus’) promotion of minimalism, customers of all ages are eschewing clutter, including paper receipts and invoices. When you allow your customers to pay via text, they no longer get invoices in the mail, and they can receive a digital receipt in place of a paper receipt.

Because smartphones are a central hub of organization for a growing percentage of the population, giving your customers the ability to conduct business with you using their mobile device makes their life easier and simpler.

Even payment reminders can be sent via text. Now, instead of having to check and sort through emails to pay you, all your clients have to do is look at their text history to find their payment link.

Text to pay is the ultimate organization tool for your customers, and it also helps ensure that you get paid faster!

Conclusion

We surveyed 380 small business customers to find out where they want to use Text to Pay options most. Though grocery stores and restaurants were the top choices, doctor’s offices also made the list.

Accepting text payments not only improves the customer experience, but it also streamlines your collection efforts and can grow your revenue. We recently launched Weave Payments, which includes a Text to Pay feature. Ready to see Weave Payments in action? Schedule your free demo today.

- Revised Guidelines Redefine Birth Years and Classifications for Gen X, Millennials, and Generation Z

- Americans barely carry around cash anymore

- Mobile Millennials: 63% Shop On Smartphones Every Day, 53% Buy In Stores

- 2019 Tech Update: Mobile and Social Media Usage, by Generation

- IndustryData

- Solutions Resources Company Pricing Get Started Log In Increasing Payments From Millennials Through Text Message Invoicing

- Why Mobile Marketing Can Be Big For Your Business, And How To Use It

- Worldwide Texting Statistics